Introduction

LMS allows for setting loan deals, on which pools of multiple loans can be set up. Fees can be added to the deal, and can be calculated and charged automatically to either the lending or the borrowing party, or to both parties. Based on a pre-selected date, LMS can automatically calculate and process the fee transactions.

Instruction video

is a separate Windows application which seamlessly integrates with Sage Evolution (‘Evolution’), allowing for the control and maintenance of all outstanding loans, without the need of any work being done twice, as all transactions can be posted directly from LMS to Evolution.

Similar to Evolution, LMS has the same customizable grids throughout the application to facilitate the provision of preferred information to every individual user.

Instruction videos

Currencies

View file name LMS - Currencies.mp4 height 250

Interest types

View file name LMS - Interest types.mp4 height 250

Loan confirmation

View file name LMS - Loan confirmation.mp4 height 250

Loan creation

View file name LMS - Loan creation (Annuity).mp4 height 250

Loan pools

View file name LMS - Loan pools.mp4 height 250

Loan statuses

View file name LMS - Loan statuses.mp4 height 250

Mass processing

View file name LMS - Mass processing.mp4 height 250

Sub-transactions

View file name LMS - Sub-transactions.mp4 height 250

Field descriptions

1. Loan overview

...

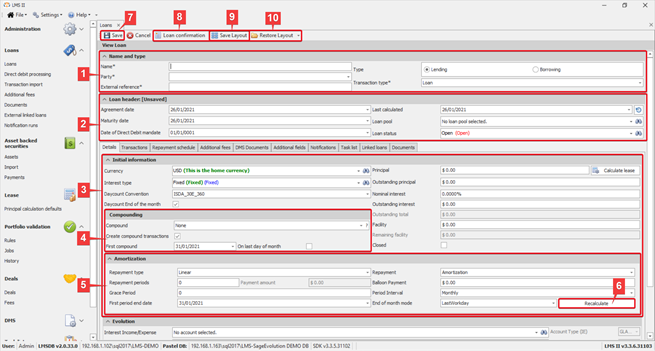

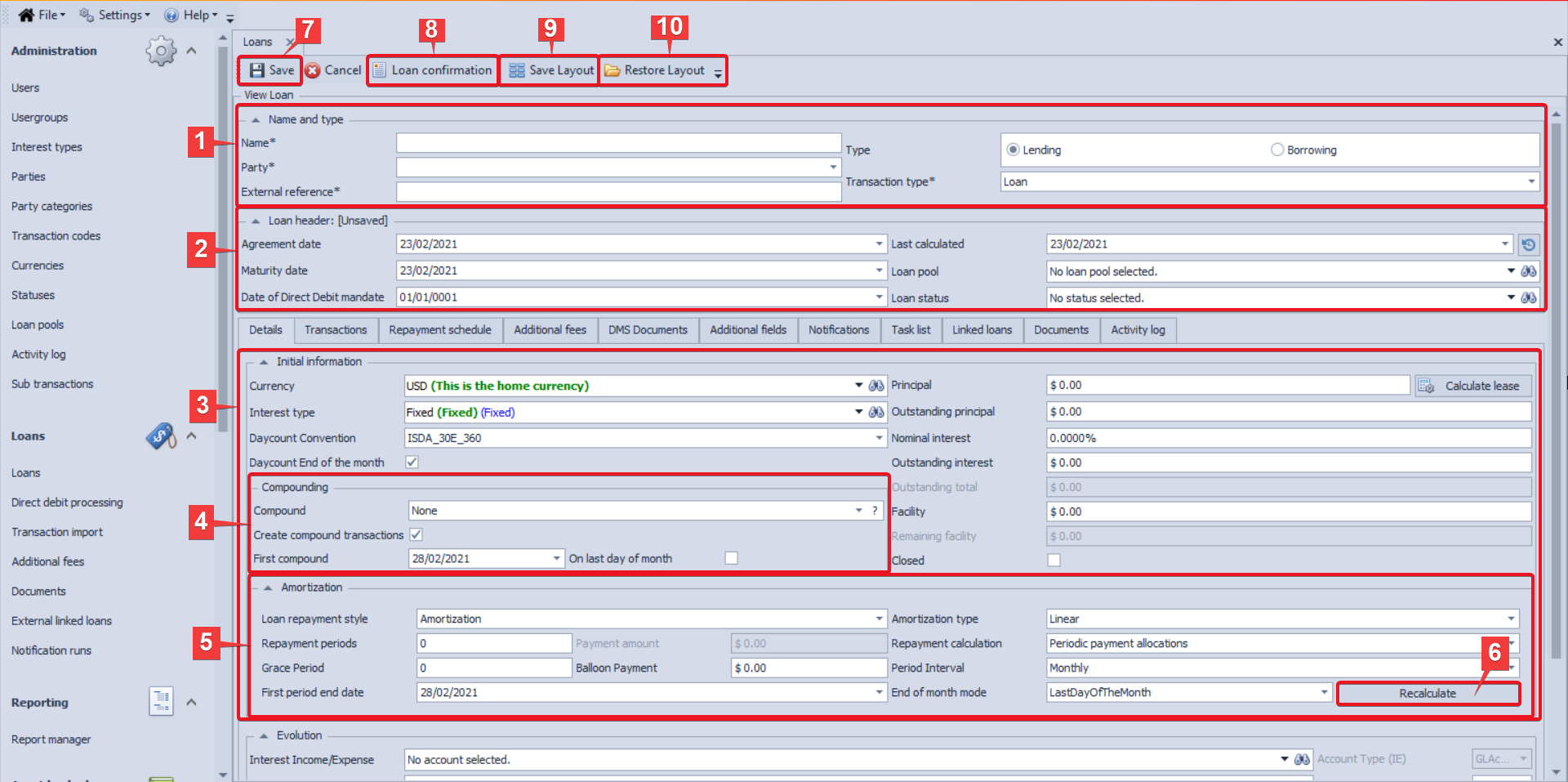

When creating a new loan, the following information is to be provided.

- Name and type

- Name: Name for the loan.

- Party: The party to/from which the loan is issued.

- Loan type: A choice can be made between lending and borrowing.

- External reference:A reference (other than the loan code, generated by the system) to be used in identifying the loan.

- Transaction type: A choice can be made between loan, receivable, car leases and originator.

- Note: For a loan to be saved a name, external reference and party are required. In the event that one or more of these are missing the user will be notified by the system (see image below).

- Loan header

- Agreement date: Date on which the loan is to be agreed on (the beginning of the loan term).

- Maturity date: Date on which the loan period ends.

- Date of direct debit mandate

- Loan status: A choice can be made between active, non-performing, open, suspended, closed, awaiting approval, fully paid, partially paid, repurchased, written off and sold.

- Last calculated: Date on which the loan was last calculated.

- Loan pool (Optional): Using this field the loan can be added to a loan pool (if any).

- Initial information

- Currency: The currency of the loan (the currency in which all transactions are to be handled) is to be set.

- Interest type: A choice can be made between a fixed and other interest type(s).

- Note: Interest types can be added under Administration >> Interest types.

- Day-count convention: The day count convention to be used in calculating interest is to be selected. A choice is available between US_30_60, ICMA_30E_360, ISDA_30E_360, Actual_365_Fixed, Actual_360_Fixed, Actual_ISDA.

- Day-count end of month: This function allows for specifying whether the day-count is to be ended at month-end.

- Principal: The amount of the newly created loan is to be set.

- Outstanding principal (Optional): This amount will automatically be set to the principal amount. It can, however, be modified if the two differ, e.g. if the new loan has been issued before recording it to LMS and has been partially repaid.

- Nominal interest: The nominal interest rate (per period) for the newly created loan is to be set.

- Outstanding interest (Optional): This amount will automatically be set to the interest amount. It can, however, be modified if the two differ, e.g. if the new loan has been issued before recording it to LMS and has been partially repaid.

- Facility: Using this function, a facility for the loan can be set.

- Closed: This function can be used to specify whether the recorded loan has been closed.

- Compounding

- Compound: A choice can be made between none, annual, semi-annual, quarterly and monthly, depending on the compounding frequency (if any).

- Create compound transactions: This function can be used to specify whether compound transactions (if any) are to be automatically created by the system.

- First compound: The date of first compound (if any) is to be set.

- On last day of month: This function allows for specifying whether the day-count is to be ended at month-end.

- Amortization

- Repayment style: For the loan repayment style a choice can be made between amortization and transactions, based on the loan agreement.

- Amortization type : A (Applicable when Repayment is set to Amortization): Where amortization is applied as a repayment style (5a), a choice can be made for the repayment type between linear and annuity, annuity, fixed payment and lease payment.

- Repayment periods/Repayment amount: The total number of repayment periods for the loan is to be set. Alternatively, a repayment amount can be provided when the Repayment Amortization type (5a5b) is set to fixed "Fixed payment" or lease "Lease payment".

- Grace period (Optional): The number of grace periods (if any) is to be set.

- First period end-date: The end date for the first period is to be specified.

- Repayment: A choice can be made for the repayment type between amortization and transactions.

- Repayment type (Applicable when Repayment is set to Amortization): a choice is available between linear, annuity and fixed payment.

- Balloon payment (Optional)Balloon payment/Residual value: An amount for the balloon payment (if any) is to be set. Alternatively, a residual lease value can be provided when the Amortization type (5b) is set to "Lease payment".

- Repayment calculation: A choice between periodic payment allocations and continued payment allocation can be made. Under the first option, the interest calculation is strictly done, based on the number of periods and the amortization type chosen, while under the second option, the interest is calculated on an ongoing basis, i.e. the interest calculation is based on the actual movement of transactions.

- Period interval: A choice for the period interval is to be made between annual, semi-annual, quarterly, and monthly.

- End of month mode: A selection can be made for the date (day) to be used as end date per period between last workday, last day of the month, and request date. Using the last option, an end date can be set per period, different from the closing-of-the-month date (e.g. 7th).

Recalculate: Using this button, the repayment schedule for the loan can be generated.

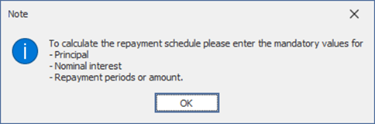

- Note: For a repayment schedule to be calculated, Repayment style (5e5a) is to be set to “Amortization” and the principal amount (3e), nominal interest (3g) and repayment periods or amount (5b5c) are to be provided. In the event that one or more of these are missing, the user will be notified by the system (see image below).

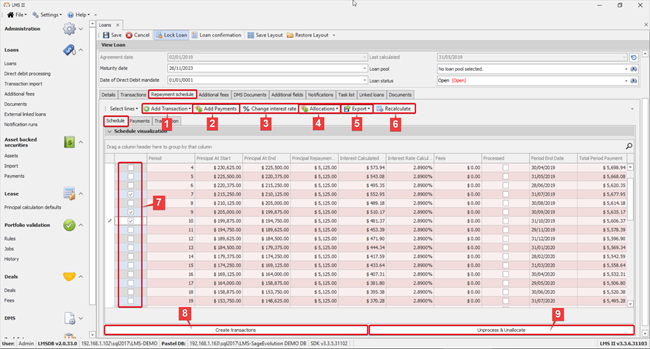

The repayment schedule can subsequently be found under the "Repayment schedule" tab, providing details (per repayment period) of principal amount at the start and end of the period, amounts of principal and interest to be pad paid for the period, amount of fees applicable per period, period end date and total payment for the period (see image below).

The following functions are further available: (1) Add transactions; (2) Add payments; (3) Change interest rate; (4) Allocations; (5) Export; (6) Recalculate. In the event that an interest rate change is made,

Transactions can be created by selecting the desired periods – by ticking the checkbox in front of each period (7) – and using the "Create transactions" button (8). Accordingly, already processed periods can be unprocessed and unallocated, using the “Unprocess & Unallocate” button (10).

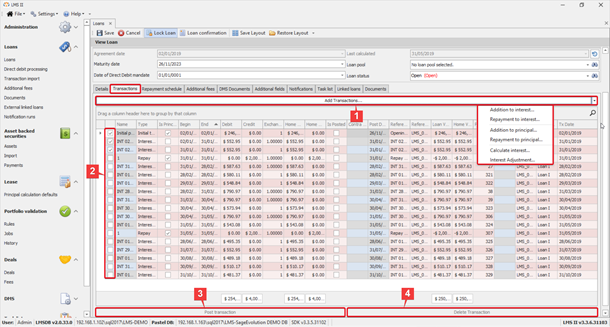

The created transactions can be found under the "Transactions" tab (see image below). Transactions for the according loan can also be added, using the "Add Transactions" button (1) – a choice is available between additions and repayments to interest and principal, and interest calculations and/or adjustments. Further, the created transactions can be posted (3) or deleted (4), by selecting the desired transactions and using the according buttons at the bottom.

- Save: Using this button, the newly created loan can be saved in the system.

- Loan confirmation: Using this function, a loan confirmation report can be generated, by specifying the desired range in time (see image below). The new report can be created (1) and/or an existing report can be edited (2), previewed (3), printed (4) or emailed (5).

- Save layout: Using this function, the selected loan’s layout can be saved.

- 10. Restore layout: Using this function, a layout, previously saved (9), can be restored.

...